tesla model y tax credit 2020

2020 Tesla Model Y. Model Y achieved NHTSA 5-star safety ratings in every category and subcategory.

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Tesla Model Roadshow Used Electric Cars

2020 Tesla Model Y.

. On July 1 2019 the credit will be reduced to 1875 for the remainder of the year. Tesla has been selling the Model S Model X and Model 3 for years already and GMs eligibility for any portion of the tax credit ended March 31 2020. Twelve Point Summary of Potential EV Tax Credits as of November 2021.

Jun 27 2019. 31 2019 no credit will be available. The 2020 Tesla Model Y True Cost to Own includes depreciation taxes financing fuel costs insurance maintenance repairs and tax credits over the span of 5 years of ownership.

Eliminates the 200000 cap on cars eligible for tax credits for cars bought after May 24 2021 only Senate version. November 14 2021. There is a federal tax credit available for most electric cars in 2021 for up to 7500.

January 1 2023 to December 31 2023. Safety is the most important part of every Tesla. That should be fair sales for US buyers and from all auto manufactures sold in the US.

Tesla was too popular. However if you are in the market for a Tesla Model Y then you might not get as sweet of a deal. Lets hope they approve an extended Federal Tax credit of 7500 for all until a date such as 2024.

Tesla and GM are set to regain access to tax credit worth 7000 on 400000 more electric cars in the US with new proposed reform of the federal EV incentive program. Residential Federal Tax Credit Business Federal Tax Credit For Systems Installed. In 2020 that tax credit was reduced to 26 and it will drop to 22 next year.

Model Y received the IIHS Top Safety Pick award with top ratings in all crashworthiness and front crash prevention categories. Tesla blew past the ceiling for tax credits on electric cars in 2018 and that makes the final date to qualify for the remaining tax rebate. This federal tax credit ranges from 2500 to 7500 for qualified electric vehicles that draw energy from a battery.

Continouing with its price cuts Tesla has once again lowered the price of the Model 3 Y. We design our vehicles to exceed safety standards. All of the Tesla lineup models including the Model S Model X Model 3 and Roadster have exceeded the limit.

Most importantly the provision includes nixing the 200000 ceiling on these credits -- the cap Tesla and GM passed in 2019 and early 2020 which triggered a. 3750 for tax years 2025-26. Long Range AWD change trim Avg.

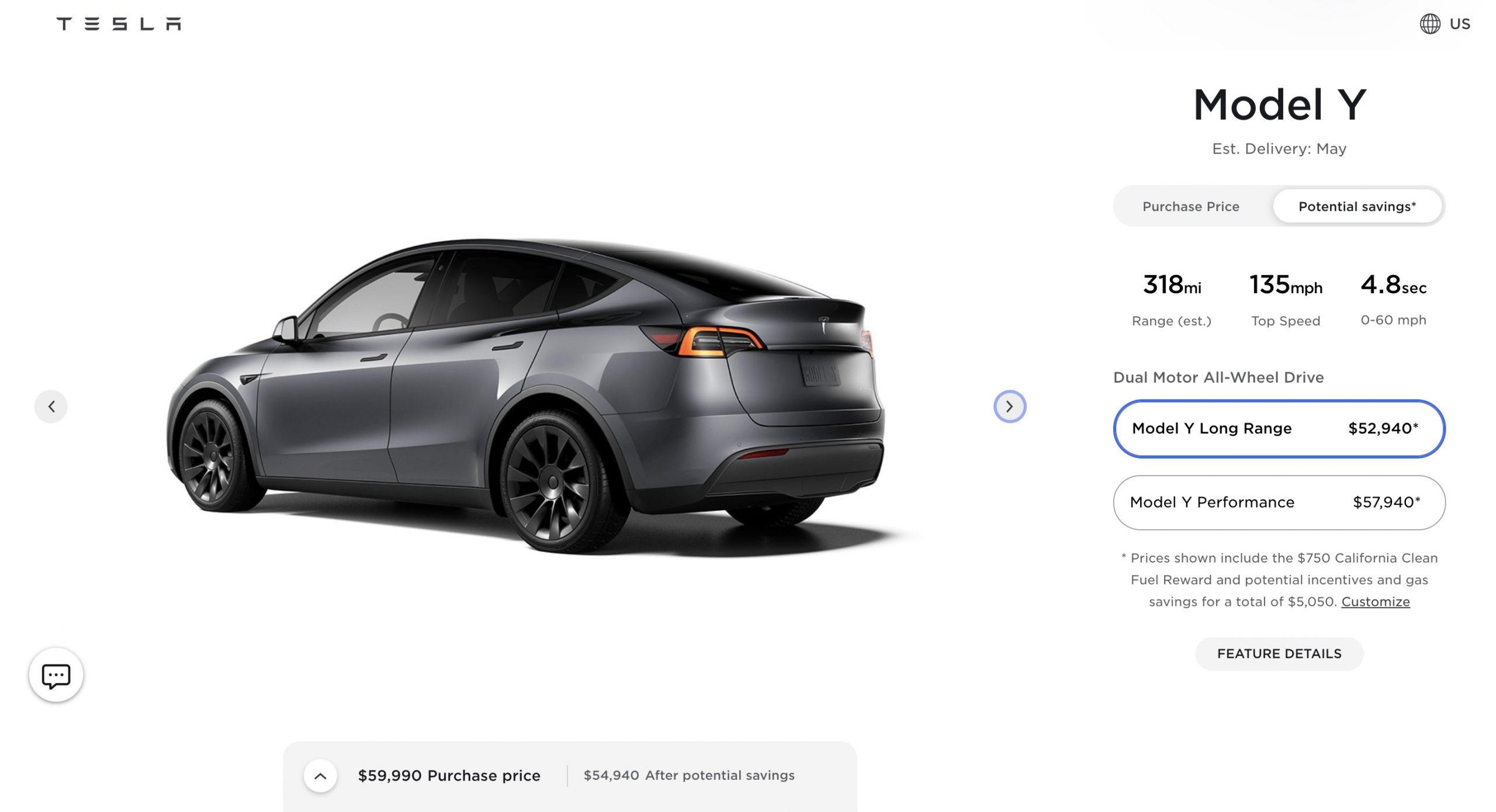

Model Y Price Based on Trim Look up vehicle price. The new EV tax credits proposed by the Biden administration are bound to encourage more EV sales. On or after January 1 2024.

Then require only new zero emission autos sold after 2050. As of now only GM and Tesla have reached 200000 EVs produced. For instance once Tesla sold 200000 vehicles no matter which model it was the credit was phased out.

The price cuts come as the recently proposed law to renstate the 7000 EV tax incentive makes EV buyers. To put it simply. 1 2019 the credit will be 3750 for Teslas eligible vehicles.

January 1 2020 to December 31 2022. Are Any Other Manufacturers Close to. Vehicles model y model y.

The credit is non-refundable so to enjoy its benefits you must have a federal tax liability in the year of purchase and file Form 8936 to claim the credit. Initially the tax credit was cut in half from 7500 down to 3750. Tesla has been selling the Model S Model X and Model 3 for years already and GMs eligibility for any portion of the tax credit ended March 31 2020.

In anticipation of the upcoming EV tax credits Tesla is adjusting its pricing accordingly. Trade-in Value Get a cash value for your car. This includes US automakers like Tesla who topped over 200000 qualified plug-in electrics sold a few years ago and as a result no longer qualifies for any federal tax.

Given that this solar tax credit cut is coming up and rooftop solar power is a decent portion of teslas business the company recently tweeted out a reminder of the approaching deadline. Answer Simple Questions About Your Life And We Do The Rest. Ad From Simple To Complex Taxes Filing With TurboTax Is Easy.

File With Confidence Today. GM and Tesla were thus no longer eligible for the EV tax credit so both companies stand to benefit. The new EV tax credits proposed by the Biden administration are bound to encourage more EV sales.

Today January 1 2020 with the beginning of a new quarter there is no federal tax credit available for new Tesla cars sold in the US. Qualifying vehicles by the manufacturer are eligible for a 7500 credit if acquired before Jan. Once upon a time federal income tax credits for car buyers buying electric cars -- ranging as high as 7500 for a single car -- helped to make Tesla NASDAQ.

Is The Tesla Model Y Really Worth 60 000 Will Orders Slow Down

Elektromobilis Tesla Model Y Volt Lab

Pictures Surface Of Tesla Model Y Third Row Seats And They Don T Look Large Tesla Model Tesla The Row

Elektromobilis Tesla Model Y Volt Lab

Tesla Model 3 Model Y Gets 1k Price Increase New Free Paint Option

Tesla S Model Y Will Arrive By 2020 Here S Everything We Know About The Suv Tesla Model Car Model 2018 Tesla Model 3

Tesla Model Y Consumer Reports

Tesla Model 3 Y Axed From Cvrp Rebate After Price Hikes From Inflation Pressure

Nickel Price Spike Makes Tesla Model 3 Model Y 1 000 More Expensive Topcarnews

2018 Tesla Model Y Modelos De Tesla Tesla Coches Nuevos

Tesla Model Y Monthly Payment Off 69

Tesla Hikes Price Of Model 3 Model Y By 2 000

Tesla Model 3 And Model Y Receive Latest Round Of Price Increases In Us And China